Up to $20k student loan forgiveness announced for 27 million borrowers

STUDENT LOAN FORGIVENESS UPDATE

SCOTUS blocked Biden’s forgiveness plans in June 2023.

Read more about what the Supreme Court decision on forgiveness means for you.

The Biden administration has just announced student loan forgiveness for millions of borrowers- a huge and unprecedented move that will positively impact borrowers and the financial services industry alike.

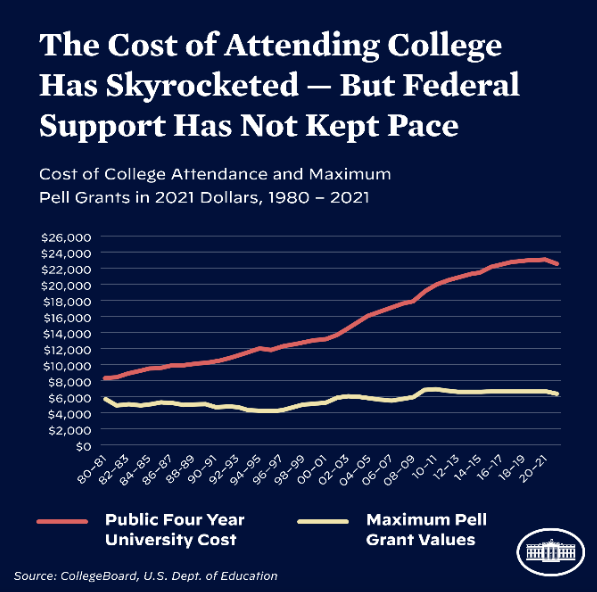

Source: CollegeBoard, U.S. Dept. of Education

What this opportunity means for the industry

Not only will eligible borrowers receive up to $20k in student loan forgiveness, but 90% of this debt cancellation is going to borrowers who earn less than $75k.

In total, 43 million borrowers will receive relief from a large financial burden in only a few short months. With $330B forgiven total, this will wipe out the student loan debt of one-third of all borrowers!

This is a huge opportunity for financial services. Millions of borrowers can grow their wealth and will be making major life changes by:

Investing more

Paying off other debts

Buying homes and cars they need

Starting families

Source: U.S. Dept. of Education

Remember, 44% of borrowers eligible for this forgiveness are ages 26-39, so the people getting the most forgiveness are the ones leading the spending categories above.

Make claiming forgiveness easy for borrowers

If you work in financial services, it’s likely many of these eligible borrowers are using your tools or platform right now, looking for a frictionless path to claim student loan forgiveness.

We’re the only embeddable b2b provider who automates enrollment into federal programs. Any financial app can leverage our existing loan automation so millions of borrowers can have an easy way to leverage their forgiveness come Jan 1.

You can help borrowers get the financial outcomes forgiveness brings with help from Payitoff all in-app. Talk to us now to get everything you’ll need up and running prior to Jan. 1.

Forbearance is finally ending…and most borrowers need a game-plan

And, let’s not forget the remaining two-thirds of borrowers are going to face payments resuming in just four short months. Since 90% of current borrowers are utilizing this payment pause, that’s a lot of borrowers in need of a game-plan for when payments begin. From refinancing to federal programs, borrowers have more options than they expect and we’re here to help every borrower get the best financial repayment outcome possible.